This journey to Financial Freedom and a more Minimalist lifestyle has fueled my desire to improve in other areas as well. Like most of us, I need to get healthier. I'm not overweight, but I have my problem areas I would like to improve. Additionally, I don't eat enough fruits and vegetables or drink enough water. I've given a lot of thought to what lifestyle changes I can make to improve my health and drop a few vanity pounds without resulting to dieting. Here are the 20 rules I plan to begin to implement on July 1. I feel the rules are fairly simple and painless to apply, given just a little bit of effort. The rules are a combination of my own creations and a few I have picked up from reading about health and nutrition. So here they are, Young Mogul's 20 Rules for a Healthier Eating Plan:

All of the rules are applied Sunday through Thursday (except water intake and multi-vitamin)...on weekends, GO WILD!

1. No eating after 8p.m.

2. Always start the day with a healthy, meatless breakfast

3. Only 10 grams of fat a day from junk food. You can divide junk food into salty/sweet

4. No junk food as a meal (i.e. donuts for breakfast, French fries for lunch)

5. Limit sugar intake (no specific number of grams, just consciousness)

6. Eat a fruit or vegetable with every meal

7. Stop eating when the joy derived from the taste of the food has diminished

8. Don’t eat the same type of food for back-to-back meals

9. Don’t drink calories. Drink only water with meals other than breakfast

10. Drink a minimum of 20 ounces of water a day (more if possible), even on weekends

11. No white flour

12. No deep fried foods

13. Eat reasonable portions

14. Choose healthier version junk food (dark chocolate, skim milk Frappucino, baked chips)

15. Choose lean meat choices whenever possible

16. Limit carbohydrate intake (no specific number of grams, just consciousness)

17. Get a minimum of 20 minutes of exercise (more if possible), ANY five days a week

18. Take a daily multi-vitamin every day, even on weekends

19. Friday and Saturday are “anything goes” days, except for water intake & multi-vitamin rule

20. Post these rules in a prominent place at home and work and review daily

Labels: Healthy Eating, No Dieting

First of all, let me start by saying that I took my debit card out of my wallet on the first day of the month, so I did not use it in this incident. However, the situation is...I went out with a group of friends on Saturday night. It is well known, from my 'About Me' profile, that I am a handbag connoisseur, LOL. So, I own both day and evening handbags. When I went out with friends on the weekend, I took one of my cute, going out, small clutch-type handbags that can only hold my wallet and lip gloss. Fast forward to Tuesday when I went to the service department of my car dealership. I had an oil change and front brake service. Because I didn't know, in advance, the exact cost of the service I had already decided I would simply write a check for the amount instead of trying to withdraw an unknown dollar amount from the bank.

My car service was completed to the tune of $286 and some change. When I went to pay for the service I realized I had not put my checkbook back into my current purse of the day. This was discovered AFTER the service was completed and I was at the payment counter. Although I had already removed my debit card from my wallet for the month, I decided to keep my American Express card, just in case. And luckily I did or else I may have been leaving the service department in a police car--or maybe not, I am a regular. So, although I didn't use my debit card, I still used a credit card--which was also prohibited for the Challenge.

So the question I'm asking is, did I violate the Challenge? You decide by leaving your comment...but before you decide, allow me to plead my case. First, I did NOT use a debit card because I have not carried it with me for the month. Secondly, the purpose of the Challenge was to make the participants more conscious of how we spend our money and not to spend on mindless, frivolous purchases. This was definitely not a mindless or frivolous purchase. Either way, I will still continue the challenge for the remainder of the month.

Did my love of handbags cost me the Challenge? You be the judge...

Labels: 'Go Green' Challenge

Does anyone remember that Lending Tree commercial? You know...the one with the middle aged, Caucasian, family man, riding on his mower with the plastered on smile, who went on and on about his big house, fancy cars, etc; then stated that he affords it all because he's in debt up to his eyeballs--all with the same permanent, fake smile on his face? Come on, you know you remember it....

I thought about this commercial when I thought about doing this post. Is it worth it to have the big house and fancy cars at the expense of your happiness/peace of mind? Do you have any of these symptoms:

* Stuck in a job you hate because you can't afford to leave

* You're working more than one job (not a side business) just to make ends meet in regards to your necessities?

* Are you sacrificing free time, hobbies, volunteer activities in the name of working longer and harder?

* Are you sacrificing quality time with friends and family because you are too tired after a very long day at the job?

* Are you constantly stressed? About the career? Bills? Retirement?

* Are you neglecting your health in the name of the Almighty dollar? Are you overweight because you simply don't have the time to cook nutritious meal or exercise? Do you have stress related stomach problems? What about migraines?

You'd be surprised (or not) at the number of people who are living a life of quiet desperation--and most of them earn a great income. We have all heard the saying, 'It's not what you earn, it's what you spend'. There are so many who are sacrificing their life for material possessions. The book 'Your Money or Your Life' calls this 'making a dying'.

So, the question is, are you making a dying?

Labels: Living Above Your Means

Since beginning this 'Go Green' Challenge I have encountered an unexpected delightful surprise...I repeatedly find money in my pants pockets and in previously used handbags. Since I am not accumstomed to carrying cash this is definitley a new occurence. It is amazing how little money I find myself spending when I carry cash. As a result, I completely forget that I have cash--until I find it later. During the act of doing laundry or changing handbags, this has happened several times during the last three weeks.

I'm not complaining, keep the found money coming...

Labels: 'Go Green' Challenge, Found Money

I Resisted Temptation and Honored My 'Go Green' Challenge

11 comments Posted by Young Mogul at 11:16 PM

I need a vacation so desperately. However, unlike everyone else, I don't get to take my vacation during the summer because of the nature of my job. You see, I am a Director for a college preparatory program that prepares high school students for higher education. During the summer component of the program, the students have a six week residential program which allows them to stay on campus and have the simulated college experience. My summers, for the last three years, have been spent dealing with teenagers (oh, the joy...) and working extended hours. The weeks leading up to the program are grueling, with all of the last minute issues that must be addressed, no matter how much planning is done in advance to avoid them.

Despite my exhaustion and a chance for a short escape before the start of my summer program, I turned down a weekend trip with the girls to Atlanta. I really could have used the get-a-way, but I decided to hold strong to my 'Go Green' Challenge. I will reward myself really handsomely at the end of the summer.

In regards to the spending plan, I am well within my $40 a week. During the summer, my program pays for all staff and students to eat 3 meals a day in the cafeteria. Therefore, my daily frivolous spending has been eliminated.

All-in-all, I'm still on track to meet my challenge throughout the month of June.

Labels: 'Go Green' Challenge

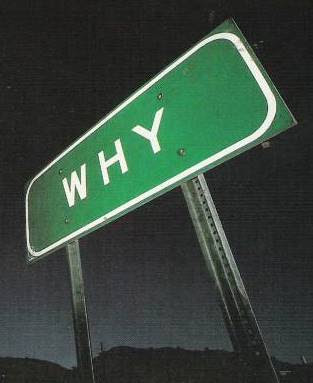

I often ask myself why, without any concrete financial role models in my life, I became the financially repsonsible person in my family. Admittedly, I was raised by a grandmother who was not frugal, but cheap. And when I mean cheap, I mean cheap; the cheapest of everything from soap to toilets. Quality was not even an issue for her. For her, it was all about the lowest price. Her motto was, 'If you have a dollar, save a quarter.' And while I never strived to be that extreme and am definitely not cheap (because 'cheapest' comes with its own set of problems that my grandmother learned the hard way), I somehow got "it"; don't ask me how or why because I don't know. My sister, who was also raised by my grandmother, didn't get "it", in my very humble opinion. Don't get me wrong, my sister is financially responsible in her own way. But, she is the type that likes the latest and greatest of most things. She is not in debt (that I know of). But, she is one of those "I work hard, so I deserve it" people.

My sister and I couldn't be more different financially--although, I would say we are the two most financially responsible in the family. I attribute our financial independence on the fact that we didn't exactly have quality parents, hence living with the grandmother. My sister and I both are single, no kids and are both homeowners. My home, although, could have been smaller, is reasonable in size and cost. My sister, on the other hand, has a HUGE house. Based on my expenses I can live comfortably from only one paycheck and save and invest the other. My sister on the other hand, has taken on a second job because she wants to "build up her savings". Here's the catch: Her home is in Hammond, LA, which is a suburb of New Orleans and a 45 minute drive. Her full-time job is from 8 to 5, from which she goes to my grandmother's home and sleeps from 5:30pm to 10:30pm, then goes to a second job from 11pm to 7am. Then, she returns to my grandmother's to change for her full-time job. She does this Monday-Thursday. She never needed to build up her savings until she bought the big house. So, basically she is currently spending her entire life working in order to pay for the big house that she is NOT even living in. When I question her choices, she says the work situation is only temporary.

Every financial decision I've made, I've told my sister about it in hopes that she would get on board. But, needless to say, she has a different mentality than me; which is fine--no judgement. Everyone is entitled to be who they are and make their own choices. For me, money is not about material possessions. Instead, in my mind, money is about security and freedom. I never want to be stuck in a job I hate, stuck in a bad relationship, forced to borrow money, etc because of my financial choices. This is just my own personal logic. But, I often ask myself why do I think this way, but no one else in my family?

I know part of the answer is I've always been inquisitive--about EVERYTHING. As a result, I became a ferocious reader. At some point, I found personal finance books and my journey started. I've always studied successful people, both in real life and from TV and biographies. But, don't most people do this in some fashion, no matter how small?

So, what do you think the difference is between people who see money as a tool/asset and those who view it as a means to material possessions? If you are a PFer, what do you think is the difference for you? I ask because I still haven't figured it out...

Labels: Financial Responsibility, Why Me?

I accepted the 'Go Green' Challenge for the month of June. The Challenge began on June 1 and ends June 30th. The jist of the Challenge is that everyone who accepts the Challenge uses cash for all of their daily purchases (not including bills), including casual spending. We use the 'envelope method', which involves putting the cash for all of our major categories in the envelope and using money as needed; but when the money is gone, it's gone. My envelopes include categories for personal spending, gas, miscellaneous, and the money I put aside for my monthly manicure. There is no use of debit or credit cards for the entire month. I already have a spending/entertainment plan which entails $40 a week for frivolous spending ($20 for the workweek, Sunday - Thursday; and $20 for the weekend, Friday and Saturday). So, my update entails what I spent for the first week of the challenge...

The Challenge began on Tuesday, June 1st. I began with the $20 for the workweek because I didn't spend any money on Sunday because Sunday is usually just attending church, then going home for a quiet day of rest. Monday was Memorial Day and, again, I rested and didn't even attend any BBQ's despite being invited. So, Tuesday was my first day of work and my first day of spending...

* Tuesday, June 1, 2010--I brought my lunch to work, but bought a soda and chips from the vending machine for $1.90. For my lunch break I went to Family Dollar and bought a few items that costs $4.56, from my miscellaneous spending category.

* Wednesday, June 2, 2010--I didn't bring my lunch but bought a Backyard Burger Junior and a Sweet Tea from McDonald's for a total of $3.56. I also bought another soda and chips from the vending machine (I know, I know....) for $1.90.

* Thursday, June 3, 2010--I purchased a Caesar salad for lunch for $5.56 and a Sweet Tea from McDonald's for $1.10.

* Friday, June 4, 2010--I spent no money on food (YEAH!!) The reason for that is I work at a college and we have adopted our summer hours, which are 10 hour days from 7am-6pm with Fridays off. So, I spent no money on food/eating out because I did not go to work on Friday. However, I went to a birthday party that night and bought a bottle of Verdi to the party for a total of $6.20, from weekend spending.

* Saturday, June 5, 2010--I had plans to attend a bus ride to Memphis (2hours from Little Rock) on Saturday, but the plans fell through at the last minute, which left me with no plans for the weekend. Therefore, I decided to treat myself to breakfast for a whopping $2.74, and lunch for $6.43...I know, I'm a big spender, LOL. Since I had not spent all of my money from the workweek, I decided to use the remaining money from workweek and weekend spending to buy myself a business book that was on clearance from Books-A-Million for $6.45.

Also on Saturday, I bought a few more miscellaneous items from Family Dollar for $3.37.

My total for the work week was $14.02, which left me with $5.98 remaining. Weekend spending was a total of $22.82, of which the additional $2.82 was remaining from the workweek. My total miscellaneous spending was $7.93.

My total cost in the spending/entertainment category for the week was $36.84 out of $40; my total miscellaneous spending was $7.93, which leaves $22.07 for the month remaining for miscellaneous spending.

All in all, I feel I did OK. I came in under budget, which wasn't hard. But, I would like to bring my lunch more often and be able to save my frivolous spending allowance for other things besides lunch. In my own defense though, adjusting to the 7am workday has been kinda hard. I brought my lunch most days before this new schedule. Also, I started a morning run on Memorial Day, which is from 5:40 - 6am. Afterwards, I have 45 minutes to shower and get dressed, which isn't hard as long as I prepare my clothes overnight--but it leaves no time for packing a lunch. I know, I know, I have to pack it overnight, which requires better planning on my part.

First week complete...

Since adopting a more Minimalist lifestyle, there are a few things I wonder why I ever wasted good money on. Adopting a Minimalist lifestye requires before any new purchase, the following questions are asked: Do I REALLY need this item?; How much use will I REALLY get from this item?; Can I borrow this item, rather than buy it?; Is this purchase in line with my new values?

Given the new consciousness I employ before making a purchase I am more aware of those items I will never waste my hard earned money on again:

* Cable TV--I can watch any television program from network television to cable programming on the internet for free. In fact, a new report released by the Yankee Group indicates one in eight Americans will drop their cable TV subscription before the end of 2010. So, I actually consider myself a trendsetter in this area because I have been without cable since 2008--Yeah me!

* Magazine Subscriptions--I now assign one Saturday out of the month library day. On this day, I read all of my favorite magazines for free, then LEAVE them at the library--no more unnecessary clutter to recycle. This is also the day I check out or return any books I want to read/have already read.

* A NEW car--I will probably never be car-free, like some Minimalist. But, I will certainly never pay full price for a such an expensive depreciating asset again. From this point forward, it is Certified Pre-Owned all the way, baby!

* Home Decor--There are entirely too many consignment stores that sell these items in excellent to very good condition at a fraction of the cost. Why do I need a brand new vase anyway? Or picture frames or lamps?

*Gym Membership--I love running and it is free. Besides, I never got my money's worth because the act of having to drive to the location to work out was just too much of a hassle for me. I used the membership only because I was paying for it, not because I enjoyed it. So, never again.

*A Pet--there are thousands of perfectly good pets at the pound who need a home, especially after many pet owners could not afford to keep their pets due to the effects of the Great Recession. Sure, I'll have to pay to have the pet spayed/neutered and vaccinated, but not for the pet itself.

*Ringtones--they are ridiculous to me. No offense to anyone who has one, but I just don't get it. My phone can have a regular ring like in the old day, circa 2005. This is just another way cellphone companies have found to jack up the cost of the service--and consumers are falling for it hook, line and sinker.

So, that's the short list of the things I will never pay for again. What are some things you will never pay for or never pay for again?

Labels: Waste of Money